The fall and rise of Eastbourne council debt

By Rebecca Maer, Eastbourne Reporter, and the BBC-funded Shared Data Unit

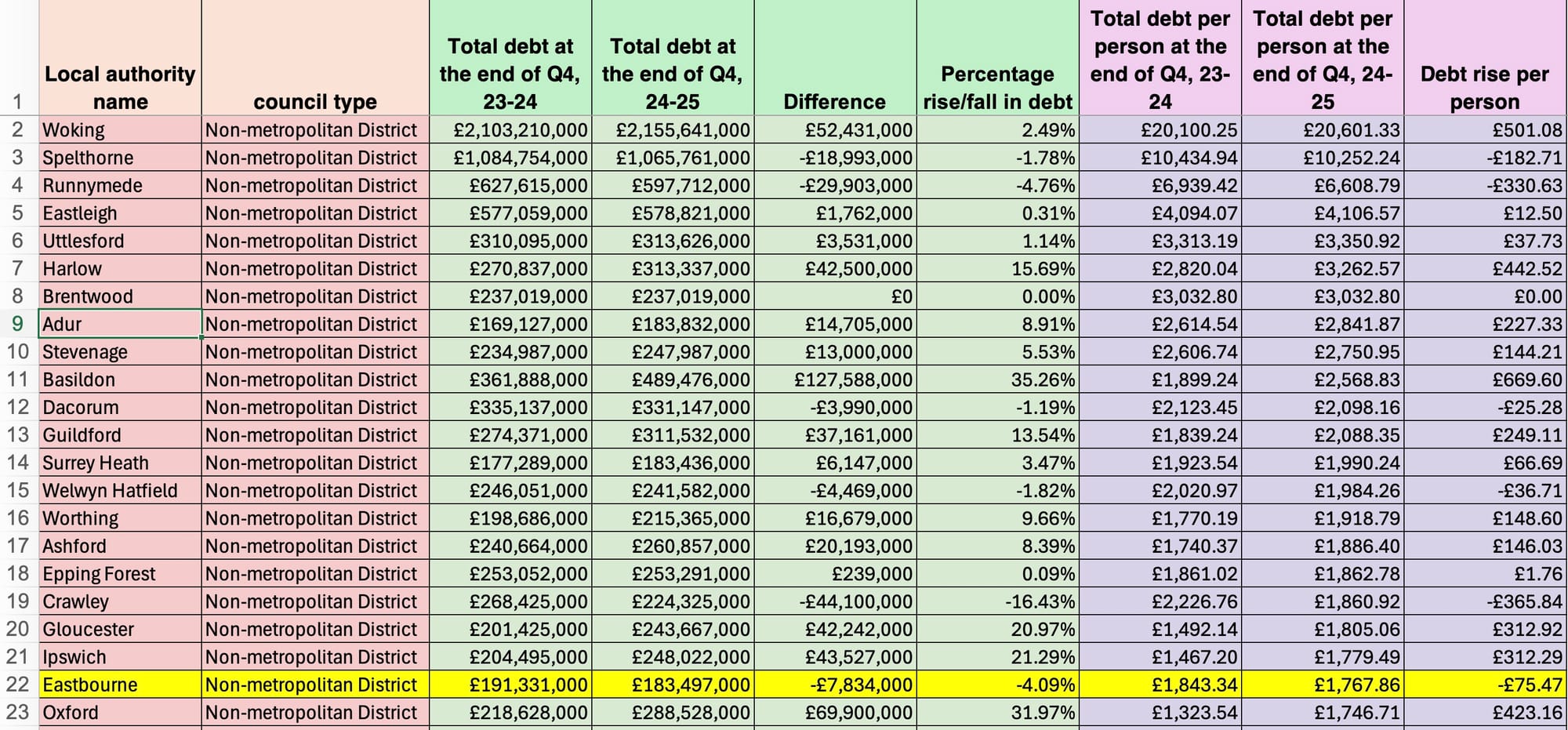

Overall debt at Eastbourne Borough Council fell slightly in the last year but is forecast to rise again in each of the next three years.

The amount owed was down by four per cent between 2023/24 and 2024/25.

The sum dropped from £191.3 million to £183.5 million, according to Government data.

The council's debt still amounts to £1,767.86 per resident, a fall of £75.47 from the previous year.

Eastbourne is in the top 20% of non-metropolitan district total debt levels across England measured by debt per person: in position 21 out of 164 similar councils compared with position 16 the previous year.

In a statement responding to the data analysis, Eastbourne Borough Council emphasised that it had invested in affordable housing and had kept swimming pools, public toilets and theatres open because it had found "new ways of operating these services".

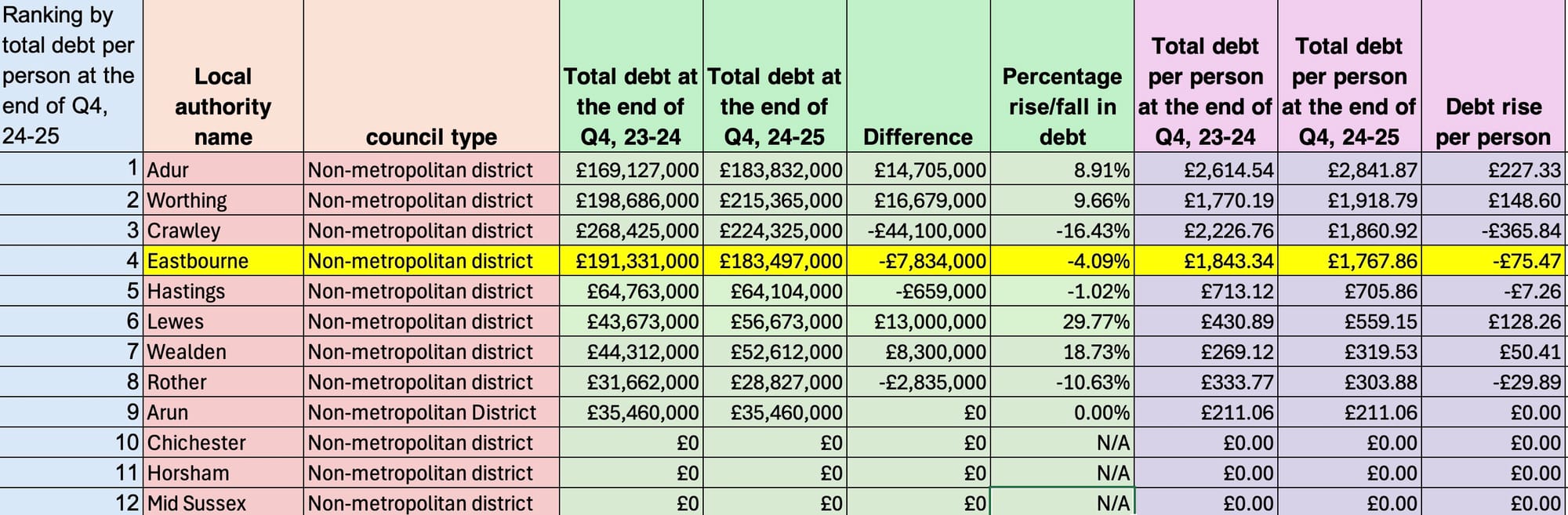

Three other Sussex districts have higher debts per resident: Adur, Worthing and Crawley.

The national figures were collated and distributed by the BBC-funded Shared Data Unit of the Local News Partnership, of which Eastbourne Reporter is a member as an Impress- regulated news website.

The figures were taken from an analysis of local government finance data from the Ministry of Housing, Communities and Local Government (MHCLG).

Analysis shows that councils in the UK added £7.8 billion to their growing debt pile in the space of a year.

The comparison is between the end of the 2023/24 financial year and the end of 2024/25.

What are the details of Eastbourne’s debt?

A breakdown of Eastbourne’s £183.5 million debt shows it has £108.5 million long-term borrowing from the Treasury, known as Public Works Loan Board (PWLB) debt, plus £75 million in short-term loans (less than one year) from other local authorities.

The Eastbourne Reporter wrote about the level of debt in the town last year as angry residents questioned why there was a plan to close public toilets and the threat of closure of some facilities at the Sovereign Centre swimming pool.

The council is thought to have spent around £54 million on redeveloping the DQ area with a conference centre and cafe, which opened in 2019, and on refurbishing the Congress Theatre.

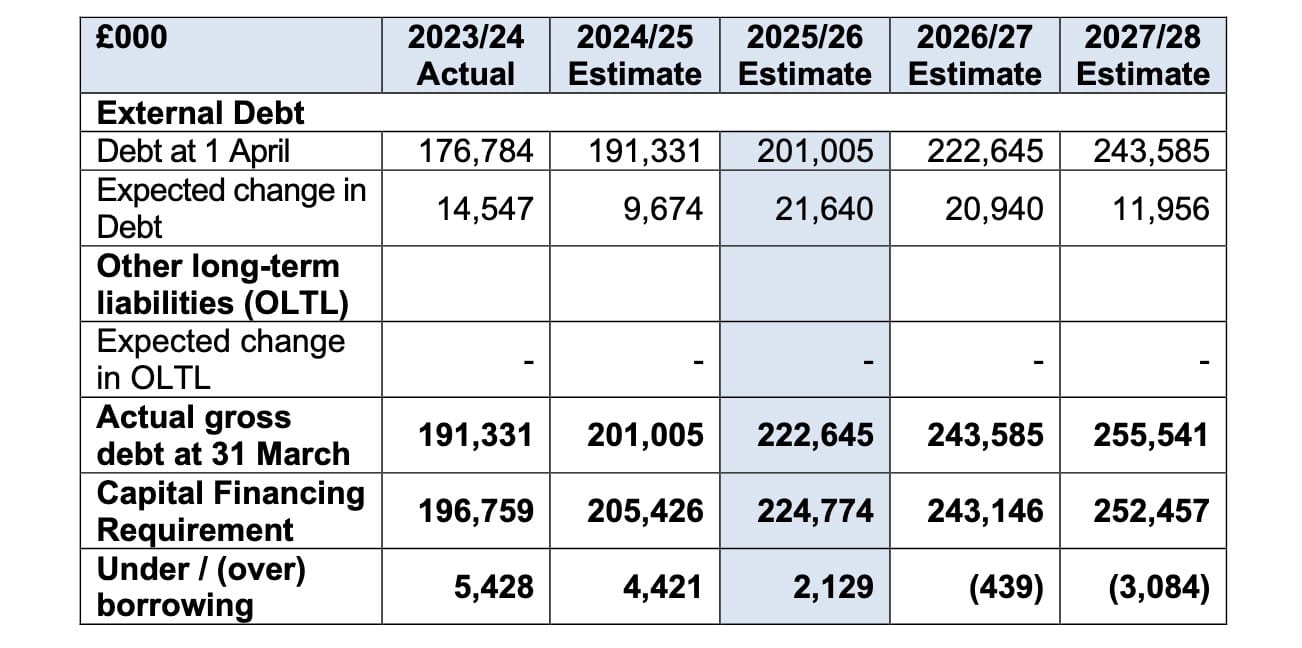

The debt in the town is forecast to rise to £201 million by the end of this financial year, according to a treasury management report presented to the counci's cabinet in February this year.

Eastbourne is fourth out of 12 Sussex districts in terms of debt per head. The next highest have substantially lower debts: Hastings with £64.1 million, Lewes with £56.7 million and Wealden with £52.6 million.

Three Sussex districts have no debt: Chichester, Horsham and Mid Sussex.

What does Eastbourne Borough Council say?

The council sent the following statement to Eastbourne Reporter today, emphasising that it has invested in affordable housing in the town:

"The reduction [in debt] is welcome and a result of savings and the strategic sale of assets.

"It is important to note that unlike most other councils in East Sussex that have sold off their housing stock, the debt in Eastbourne includes our Housing Revenue Account, which directly supports our council housing and our tenants. This accounts for about £54 million of an overall figure.

"The council has also invested £30 million in much-needed affordable housing in the town – that’s 100 new homes for our residents.

"The wider context of unprecedented financial pressures facing local government must also be considered.

"In Eastbourne, exceptionally high levels of homelessness resulted in the council spending up to £5 million annually on temporary accommodation – the equivalent of 49p in every pound of council tax collected.

"Across the UK, the government has sanctioned over £5 billion in exceptional financial support to 42 councils in recent years and the Local Government Association has predicted an £8 billion council funding gap by 2028. It is no surprise that there are many councils with much higher levels of debt, including some authorities where it exceeds £1 billion.

"A number of councils in the worst financial situations are now being run by commissioners appointed by the Secretary of State and in these cases many discretionary services, such as sports, leisure and cultural facilities, are at immediate risk of closure or have closed.

"In Eastbourne, swimming pools, public toilets and theatres remain open because of the steps taken by the council to find new ways of operating these services and the savings we have made."

The council has said in the past it must balance the books against a long-term backdrop of reduced funding, rising homelessness costs and debt levels.

That means cutting many non-essential services to leave statutory ones such as housing and bin collection.

In Eastbourne, public toilets on the seafront are now subject to a £1 charge. Another operator was found for the Sovereign Centre although it is still only likely to be open for around half the year.

The council was also running the Congress and Devonshire Park theatres, The Stage Door pub (now The Bohemian) and the Eastbourne Downs Golf Club until external operators took over.

What do the opposition Conservative councillors say?

Cllr David Small, who speaks on finance for the Conservatives and chairs the council’s scrutiny committee, said it could sometimes be difficult to find out exactly where money has been spent.

He acknowledged that there were deep cuts to local government funding in the 2010s, when the Conservatives were in power nationally, partly in a coalition with the Liberal Democrats.

Many council leaders have said they had no choice but to invest in order to fill the gap in income they used to receive from the government under the revenue support grant.

Although that grant has increased in the years since the pandemic, core spending power for local authorities is around 18% down per person compared with 2010, according to the Institute for Fiscal Studies.

Cllr Small said that after 2010, when the Conservative / Liberal Democrat coalition government came to power, it became easier for local authorities to borrow and become more entrepreneurial.

But he questioned whether public sector organisations should engage in such activity in a similar way to private companies.

Cllr Small said of Eastbourne: “They didn’t cover their backs – they took a risk and gambled that interest rates would not rise.”

What is the national picture?

The Shared Data Unit analysis shows that councils in the UK added £7.8 billion to their growing debt pile in the space of a year.

Analysis of data from the MHCLG shows UK councils owe a combined £122.2 billion to lenders, equivalent to £1,791 per resident, as of April 2025.

That is up seven per cent from a total of £114.5 billion, the equivalent of £1,677 per resident, a year ago.

Councils can borrow funds to invest in projects such as schools, leisure centres and theatres. They can also borrow to invest in property that will bring in an income over and above repayments on the debt.

But the Shared Data Unit concluded that the recent rise is partly driven by a near tripling of short-term lending from central government which, in some cases, is being used to paper over holes in some council revenue budgets rather than pay for investments and town centre improvements.

Jonathan Carr-West of the Local Government Information Unit said the spiralling levels of debt at local authorities were “extremely worrying”.

He said: “That is not a sustainable system. As one local government finance officer said to me, it's essentially payday loans for local governments.

“I don't think the government would say that’s it’s long-term ambition. They would say that is what we have had to do to paper over the cracks while we introduce a new funding system for local government.”

:: This article is not a PR handout. It is based on further research about Eastbourne extracted from Shared Data Unit figures. The Eastbourne Reporter is free to read but not free to produce. Support me for the price of a coffee just once a month here or with a one-off donation here if you believe genuine, questioning journalism is vital for this town.